Saptakoshi News Correspondent

Kathmandu. The government has given concessions in Value Added Tax (VAT) to small taxpayers. Previously, the annual Rs. The government has given four months time to submit details of transactions up to 1 crore monthly.

The Department of Internal Revenue issued a notification today that concessions have been given to small taxpayers by reducing both the tax participation cost and time. Small taxpayers can now submit their tax returns from July to October by 25th of November.

Similarly, it has been given the facility to submit tax returns from November to February within 25th of February and tax returns from March to June within 25th of July. However, the department has also requested taxpayers who want to submit monthly tax returns to inform the relevant Internal Revenue Office and Taxpayer Service Office within 15 days.

Details above 1 crore monthly:

The department has requested the businessmen who have an annual turnover of more than one crore rupees to submit the VAT statement on a monthly basis. Previously, such taxpayers used to file tax returns bi-monthly.

"Rule 26 of the Value Added Tax Regulations, 2053 has been amended and the provision that existing brick industries, hotels, tourism and movie theaters can keep the period of submission quarterly if they wish has been repealed", the notice issued by the department said, "According to the amended provision. Brick industries, hotels, tourism and movie theaters with an annual turnover of more than 10 million rupees registered for value added tax will have to file monthly value added tax returns from July 2080.

According to the revision of the Budget and Value Added Tax Regulations 2053 for the current financial year, the tax return filing period has been changed. Information officer of the department, Rajuprasad Pyakurel, said that according to the budget and regulations, the tax return filing time has been changed.

शेयर

सम्बन्धित समाचार

धरानका नगर पिता हर्क साम्पाङ् माथि आरोप : हालै सामाजिक सञ्जालमा सार्वजनिक भएको एक हाजिरी खाता भाइरल

पोखरा अन्तर्राष्ट्रिय विमानस्थलको घोटालामा संलग्नताको आरोपित समूह : प्रधानमन्त्री केपी ओलीसँग भेट

नेपालको संबिधान २०७२ लाई संशोधन गरौं भन्दै स्वतन्त्र नागरिक समाज सुन्दरहरैंचाले संविधान प्रति बिरोध

ग्राम थान मिडिया प्रा.लि दुवारा आयोजित ७ दिने मल्टिमिडिया तथा आधारभूत पत्रकारिता तालिम सम्पन्न

बालुवाटारमा बसेको पदाधिकारी बैठकमा गजुरेलको राजीनामाबारे प्रधानमन्त्री दाहाले पदाधिकारीसँग राय मागे

पहिलोपल्ट पोखरा अन्तर्राष्ट्रिय विमानस्थलबाट यात्रु लिएर भुटानको ड्रुक एयरले व्यावसायिक उडान भरे

पूर्व सचिव भीम उपाध्यायविरुद्ध जिल्ला प्रहरी कार्यालय चितवनमा साइबर क्राइमसम्बन्धी उजुरी दर्ता

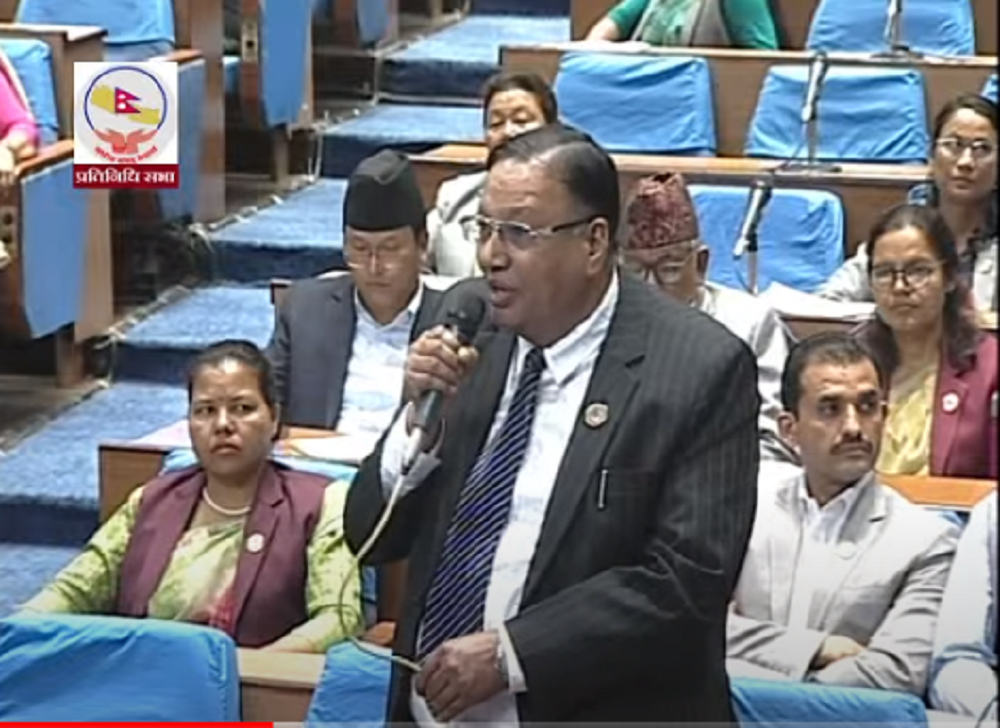

संसद अवरुद्ध किन भन्ने कुराको विषयमा स्पष्ट पार्न विशेष पत्रकार सम्मेलन प्रतिपक्ष दल नेकपा एमाले

केसीको प्रश्नः सुन तस्करीमा अर्थमन्त्री र गृहमन्त्री राजीनामा माग्ने शर्मालाई किन पक्राउ गरियो ?

कोशी प्रदेशका निवर्तमान मुख्यमन्त्री हिक्मत कार्कीले सर्वोच्चमा हालेको रिटमाथि आज सनुवार्य हुने

इटहरी ९ ग्रीनपिस लिंकन कलेजको गेटमा राखिएको शंकास्पद वस्तुको पत्ता लगाउँदै सुरक्षाकर्मी............

कित्ताकाटसम्बन्धी कानुनलाई संशोधन गरेर पुरानै अवस्थामा फर्काउने : प्रधानमन्त्री पुष्पकमल दाहाल

दुहबी नगरपालिका बाट मंगबार जारी भएको अवैध घर टहरा बनेका संरचना हटाउन ३९ दिन्रे सुुचना सार्वजनिक

TAGS

अभिलेख

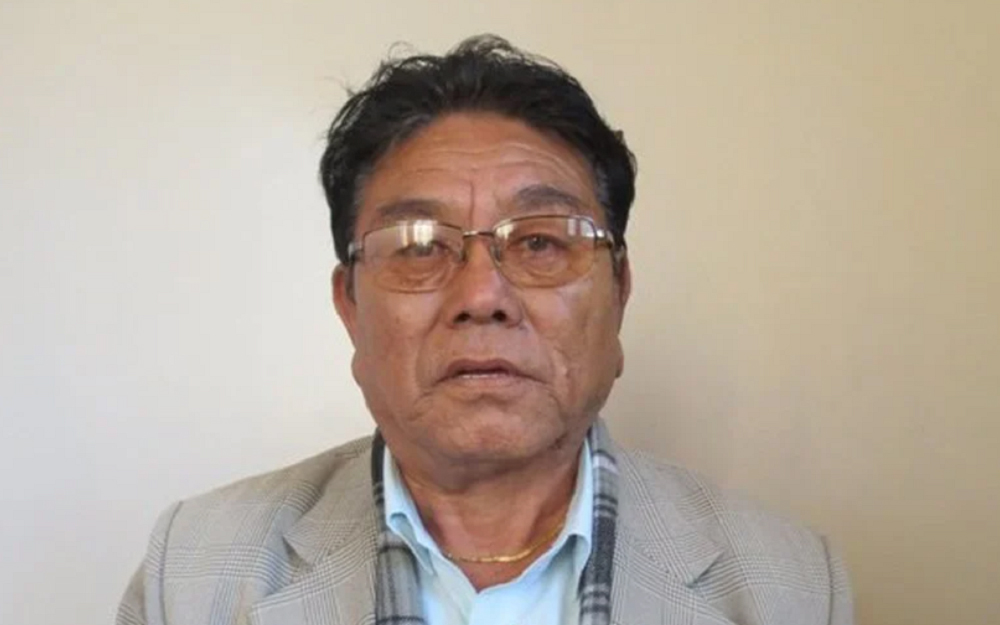

लागूपदार्थले विश्वब्यापी रुपमा फैलिदै गएको अवस्था : बेलका नगरपालिका वडा न: ४ मा अवस्थित रहेको सुर्यदय प्रतिष्ठान सुधारगृह जहाँ लागूपदार्थ दुर्वेसनिमा रहेका भविष्यका कर्णधार हरुलाई दुर्वेसनी मूक्त गरि पुनरस्थापना गर्ने कार्य तथा कृषि क्षेत्रमा समेत उधम गराउदै आएको छ । सुर्यदय प्रतिष्ठान नेपाल सुधारगृहका संचालक श्री मुकेश राई ज्यू ।

LIVE प्रत्यक्ष प्रसारण प्रम : प्रचण्ड

बराहक्षेत्र नगरका जनताहरुले रा. स्व. पा. ( नयाँ पार्टी ) लाई स्वागत गर्दै : बराहक्षेत्रको विकास निर्माण तथा यहा भ्रष्टहरुलाई पाखा लगाउने तर्क : पुराना पार्टीहरुको नेत्रित्व प्रभावकारी नभएको गुनासो गर्दै नगरका जनताहरु

लोकप्रिय पछिल्लो समाचार

टिप्पणी